How-To:Creditor Invoice

In ContactsLaw, creditor invoice journals provide a systematic way to record and track invoices received from service providers. This structure helps maintain organised financial records and ensures transactions are efficiently managed for each business entity.

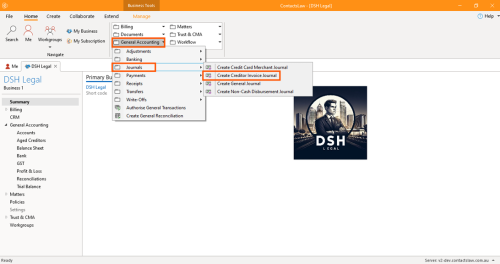

1. Getting Started

- Go to the General Accounting section within the ribbon group.

- Select Journals and click on Create Creditor Invoice Journal.

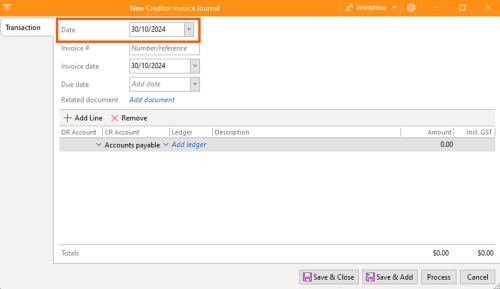

2. Specify Options

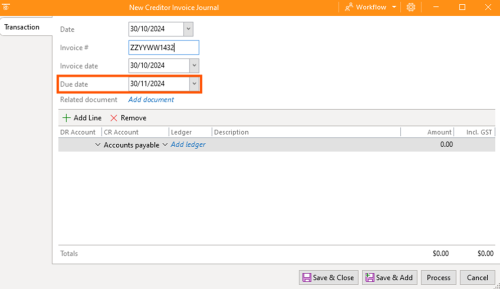

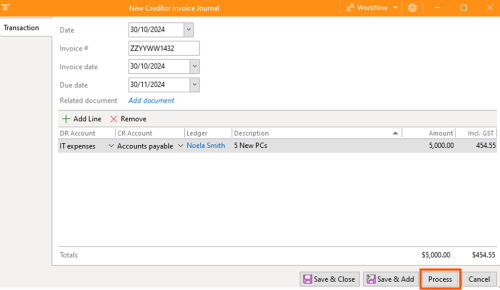

In the Creditor Invoice Journal window, several fields require input to accurately reflect the invoice details:

- Date: Set the date for recording the invoice, which can reflect past, present, or future transactions, depending on when the expense was incurred.

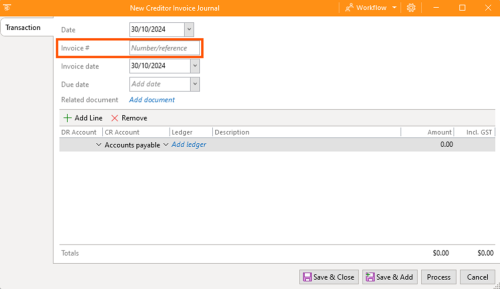

- Invoice Number: Enter the unique identifier provided by the creditor for this invoice.

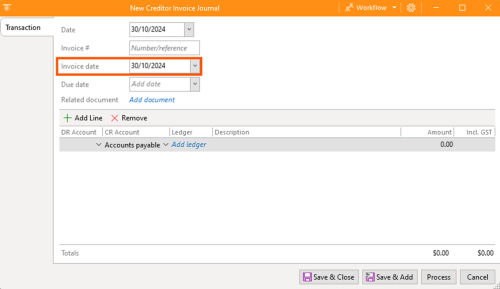

- Invoice Date: Record the date the creditor issued the invoice.

- Due Date: Set the deadline by which the invoice payment is expected.

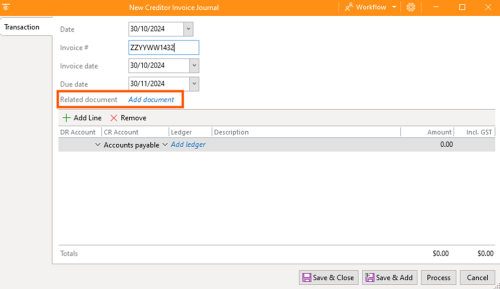

- Related Document: Upload the actual invoice file, providing documentation for the recorded transaction.

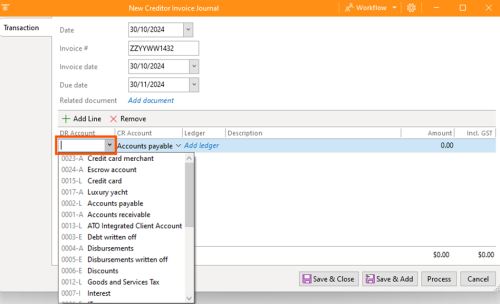

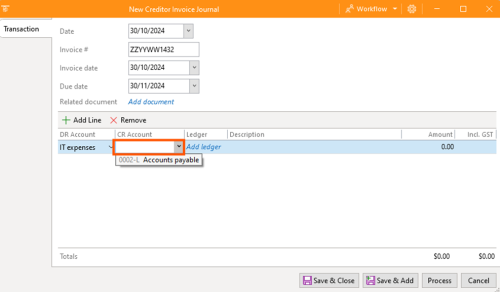

- DR Account: Specify the account to be debited for this expense.

- CR Account: Define the account that will be credited.

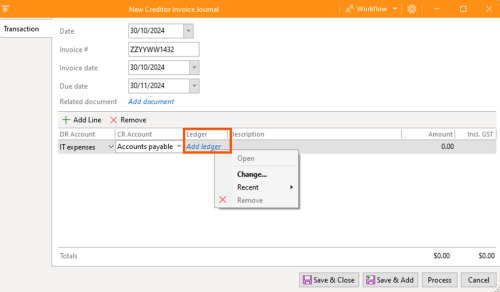

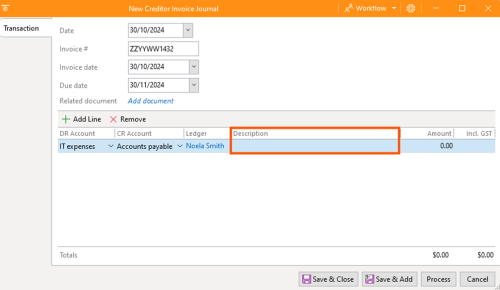

- Ledger: Identify the relevant creditor to link this transaction with the associated contact.

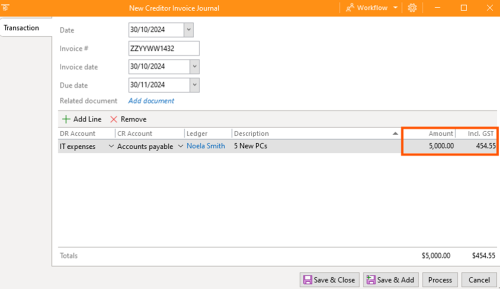

- Description: Provide a brief explanation of the invoice purpose or services received.

- Amount: Enter the transaction amount, excluding tax (or GST).

- GST: The default GST (Goods and Services Tax) in Australia is 10%. Modify if necessary to align with the tax specifics for the transaction.

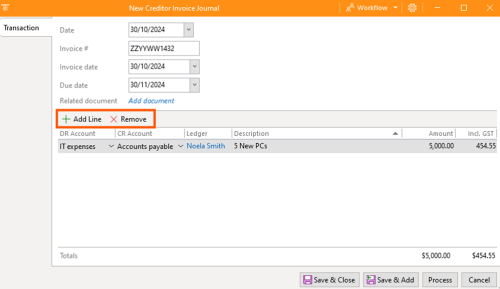

- Add and Remove Line: Use this option to add or remove line items in the invoice, allowing flexibility in detailing multiple charges.

- Process: After reviewing the entered details, click Process to finalise and save the creditor invoice journal entry.

This step-by-step process ensures that all aspects of creditor invoices are thoroughly recorded, providing transparency and accuracy in the firm’s financial documentation.