How-To:General Receipt: Difference between revisions

No edit summary |

Angele Smith (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

This section of ContactsLaw provides an overview of the recording funds that have come into the bank account.This structure ensures that financial records and transactions are organised clearly and efficiently for each business you operate. | This section of ContactsLaw provides an overview of the recording funds that have come into the bank account. This structure ensures that financial records and transactions are organised clearly and efficiently for each business you operate. | ||

There are different ways on how to find out about the receipt of funds. This article focuses on the situation where you have received funds by bank deposit. | There are different ways on how to find out about the receipt of funds. This article focuses on the situation where you have received funds by bank deposit. | ||

== 1. Getting Started == | == 1. Getting Started == | ||

Revision as of 13:58, 17 October 2024

This section of ContactsLaw provides an overview of the recording funds that have come into the bank account. This structure ensures that financial records and transactions are organised clearly and efficiently for each business you operate.

There are different ways on how to find out about the receipt of funds. This article focuses on the situation where you have received funds by bank deposit.

1. Getting Started

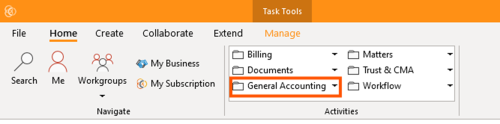

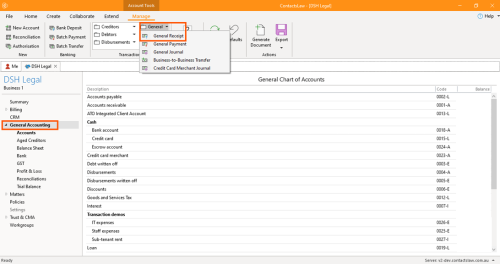

- Navigate to the ribbon group and dropdown on General Accounting.

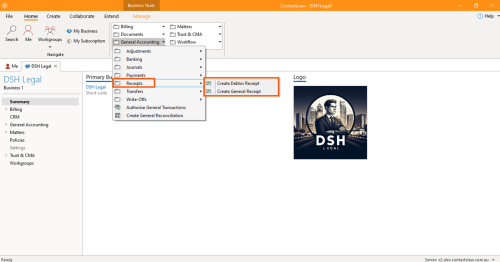

- Proceed to Receipts and either choose between Create Debtor Receipt or Create General Receipt.

2. Creating General Receipts

General receipts are for receiving funds more generally and it is going to play more of a role.

To create general receipt:

- Option 1: Click the Create General Receipt.

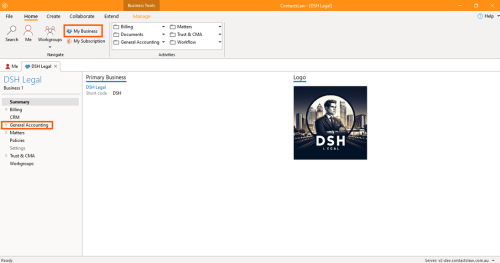

- Option 2: Navigate the ribbon group and click on My Business then proceed to General Accounting.

- Proceed to the Manage tab, then drop down the General button and click the General Receipt.

2.1. Specify Options

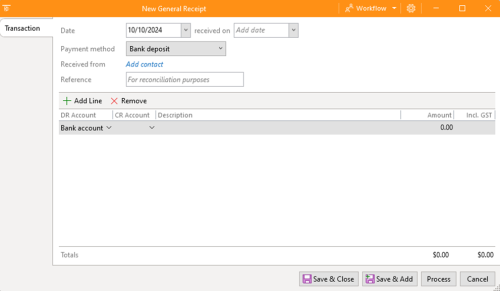

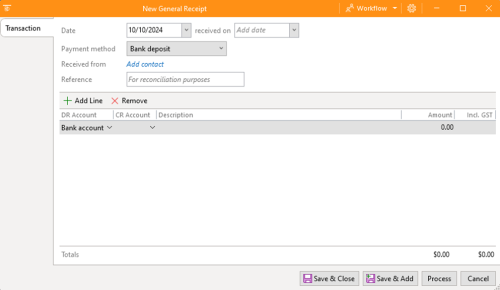

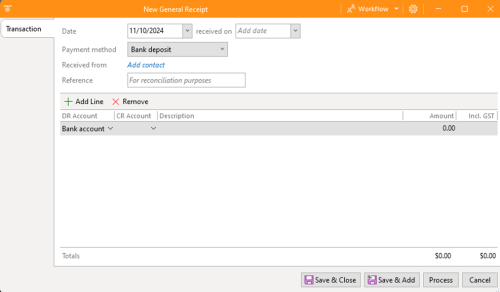

In the general receipt window, there are options that you need to fill up.

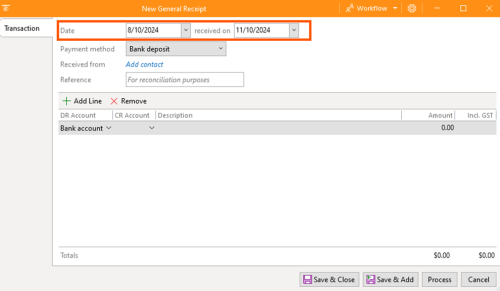

- Date: Setting the date when you issue the receipt. Date can be past, present, or future. There are in some cases there will be a different date for the date that appears on the bank account versus the date that actually received the fund.

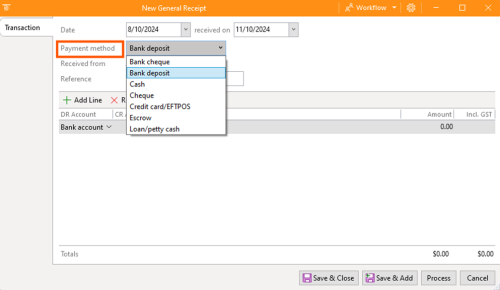

- Payment Method: This option is about how we received the funds. Options are bank deposit, bank cheque, cash, cheque, credit card, escrow, or loan/petty cash.

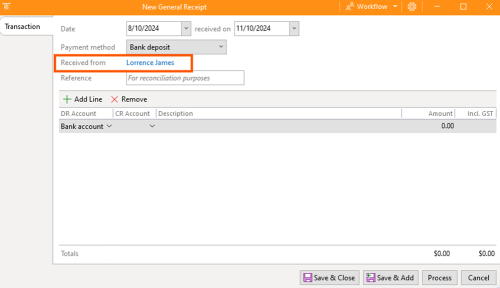

- Received from: This option is about who we get the funds from. Options are selecting a contact from the system.

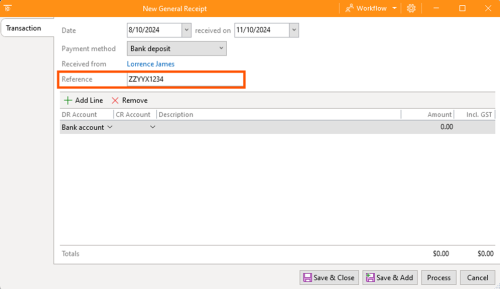

- Reference: The information for this option varies depending on the type of transaction such as invoice numbers, cheque reference number, or bank transaction reference.

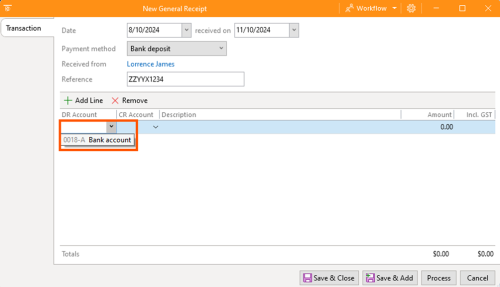

- DR Account: This option will show where the receipt will be directed. This will vary depending on the type of method.

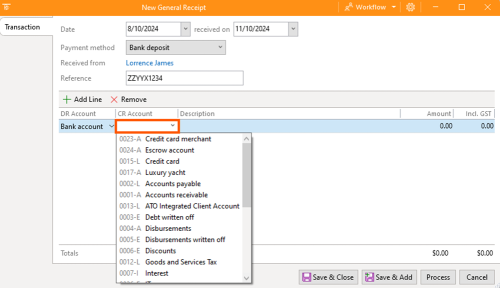

- CR Account: This option is about what account will be going to credit this receipt.

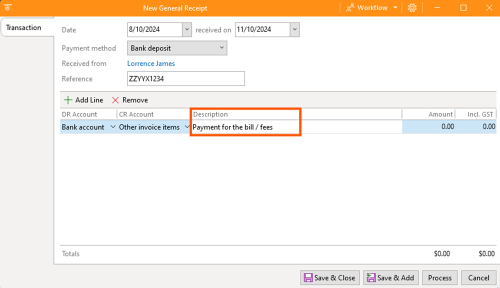

- Description: Describe what the receipt is about.

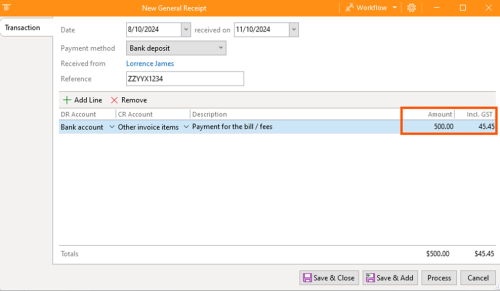

- Amount: State the exact amount of the transaction excluding the tax its gst.

- GST: This is a set of metrics or base items specific to Australia in the preparation of tax records for businesses which is 10% of the total amount. In case the GST amount is different you have the option to edit it.

- Add and Remove Line: This is an option to add another item or remove an item.

- Review the details and click Process.

2.2. Final Steps

There are a couple of ways to confirm that the general receipt you create has been successfully processed in the system.

- Option 1: Navigate to DSH Legal, proceed to General Accounting and click Bank.

- Then proceed to search the general receipt by its reference number.

- Option 2: Navigate to DSH Legal, proceed to General Accounting and click Accounts.

- Then proceed to the CR Account you indicated to the general receipt.

- Lastly, proceed to search the general receipt by its reference number or by its date.

3. Creating Debtor Receipts

Debtor receipts are specifically used for recording payments to invoices that have sent out

To create debtor receipt:

- Proceed to a matter. (see the Create Matter guide)

- Proceed to view the group, drop down the billing and click on invoices.

- Go back to the Home tab, navigate to the ribbon group and dropdown on General Accounting. Proceed to Receipts and click on Create Debtor Receipt.

- As you can see, the editor window is identical to the general receipt except for the panel on the right side of the screen, which displays a summary of the Ledger balance for this matter.

3.1. Specify Options

In the debtor receipt window, there are two (2) editor tabs that you need to fill up:

- Transactions: The information for this editor tab is similar to what you will fill up in the general receipt.

- When you input the amount data, the ledger will modify according to its calculations.

- Allocations: This tab displays detailed information on the matter you are currently viewing.

- Review the details and click Save & Close.

3.2. Final Steps

- There is a way to confirm that the debtor receipt you create has been successfully processed in the system.

- Go back to the matter. Proceed to view the group, drop down the ledgers and click on debtors.

- Then it will display the debtor receipt created. However, because we only saved and closed the receipt earlier, it has not yet been processed, therefore it has no effect and does not change balance.