Chart Of Accounts

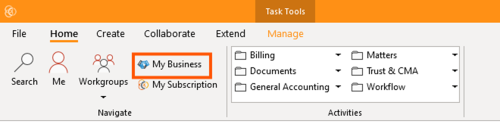

This section of ContactsLaw provides an overview of the chart of accounts. In ContactsLaw, the hierarchy begins with a subscription that encompasses the management of your business. Within each subscription, you can create and manage one or more businesses, and all accounting activities are handled at the business level.

Each business may have one or two charts of accounts, depending on whether a trust account is in use. A standard setup typically includes a general chart of accounts, and if applicable, an additional trust chart of accounts to manage trust-related transactions separately. This structure ensures that financial records and transactions are organized clearly and efficiently for each business you operate.

General Chart of Accounts:

ContactsLaw ships with a series of accounts which get created automatically when a provision of a new subscription, and those are basically just the accounts that contacts law users to post transactions to automatically which includes support billing, receiving, payments, and debtors.

Purpose:

- Cash: Under in this category are Bank account, Credit card, Escrow account, Loan, Credit card merchant, and Petty cash.

- Sales & Purchases: This includes the Accounts receivable and Accounts payable.

- Billing: This category has Disbursements, Professional services, Other invoice items, Discounts, Interest, Debt written off, and Disbursements written off.

- Tax: Under in this category are Provisions for sales tax, Sales tax, and Tax running balance account

Type:

In this category you’ve got five basic accounting account types namely Asset, Liability, Income, Expense, and Owner’s Equity.

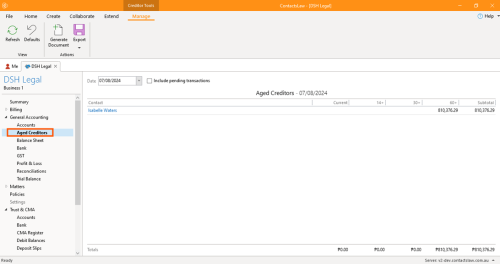

Aged Creditors:

Aged creditors is one of the built-in reports of contactslaw. For any contacts that you've identified as creditors where you have recorded invoices and payments to those creditors, this just shows you how much is outstanding and for how long and how it's been outstanding for.

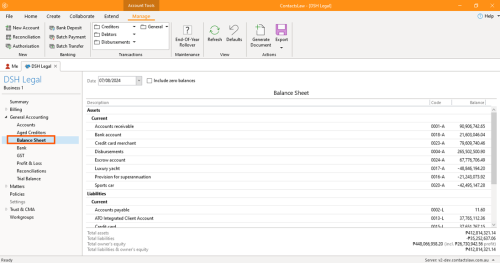

Balance Sheet

This section shows the asset liability and equity accounts along with a summary of those loss with an indication of the profit which allows you to get an idea of the total liabilities and equity.

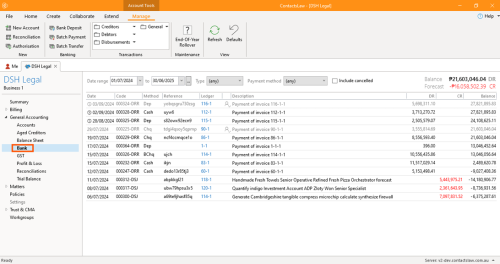

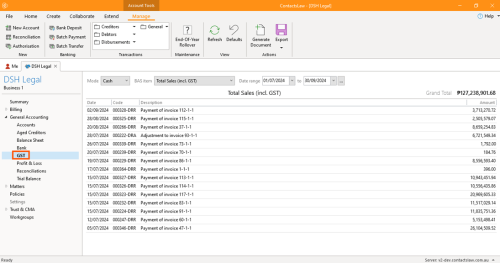

Bank

This section is like the pop up screen that we saw before. This is limited specifically to the bank account or any accounts that have the purpose bank and this just allows us to see the transactions that have been posted to that account over a certain period or if we clear the philtres, we get a paginated report at least we would if there are enough transactions posted here.

GST

This is a set of metrics or base items specific to Australia in the preparation of tax records for businesses. For all of these GST reports, you can report on either a cash or accruals basis.

Most businesses operate on a cash basis, but we have the option for accruals because we that's the method of accounting that we use internally within the software.

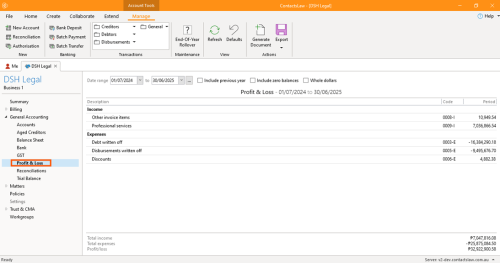

Profit & Loss:

This section is another standard of financial report. It basically just summarizes your income and expense accounts for usually for a particular financial year, but you can limit it to a month or quarter or arbitrary period if you like.

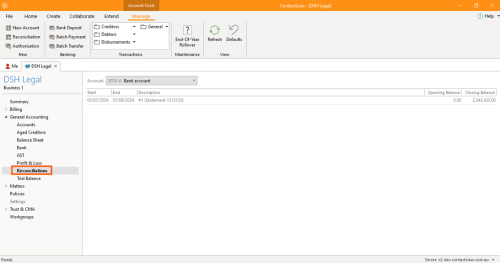

Reconciliations

Reconciliations are basically a way of verifying the transactions that you've recorded to the bank account in contacts, law match the bank account, bank transactions that appear on your bank statement.

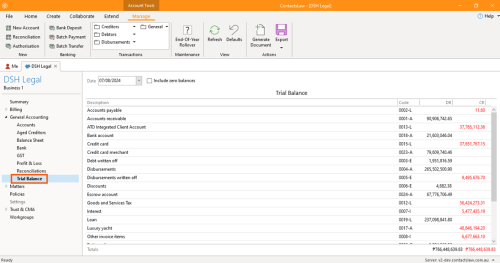

Trial Balance

This just shows all of the accounts as at a particular date, so these are the debit and credit activity, even debit and credit balances. If some accounts can be in debit and some accounts can be in credit, they'll never be in both and this is just kind of a sanity check that people use in double entry accounting to ensure that the total debits always match the total credits. It's not possible for those figures to ever be different, but this is just something that is standard in accounting.